Introduction

The foreign exchange (Forex) market, being the largest financial market in the world, presents numerous opportunities for traders. Leveraging technological advancements, Forex trade copiers have become a pivotal tool for traders, enabling them to mirror successful strategies. This article delves into the top ten Forex trade copiers, providing an in-depth analysis ideal for both novices and seasoned traders aiming to enhance their trading efficiency.

The Role of Trade Copiers in Forex Trading

Definition and Functionality

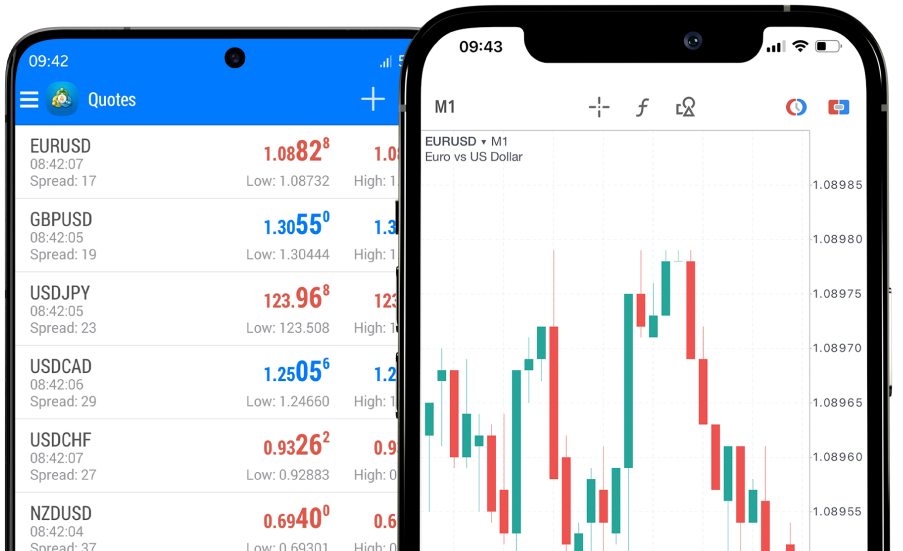

Forex trade copiers are systems that allow traders to automatically copy the positions opened and managed by another trader. This tool is instrumental for those who might not have the time or expertise to trade effectively on their own.

Benefits of Trade Copiers

Accessibility: Makes sophisticated trading accessible to beginners.

Time-saving: Automates trading processes, allowing traders to focus on strategy refinement.

Risk Diversification: Copies trades across different accounts, spreading risk.

Evaluating Forex Trade Copiers

When selecting a Forex trade copier, it's crucial to consider several factors to ensure that the tool aligns with your trading goals and risk tolerance.

Key Factors to Consider

Reliability: Ensures consistent operation without significant downtimes.

User Interface: Should be intuitive and user-friendly.

Cost Efficiency: Analyze cost versus benefits, as some copiers offer more features for a premium.

Top 10 Forex Trade Copiers for EasyCashBackForex

MT4 to MT5 Copier

Signal Start

Duplikium

Forex Copier

ZuluTrade

eToro

CopyFX

FxBlue

MQL5 Signals

Local Trade Copier

These copiers vary in features like automation level, broker compatibility, and pricing, catering to a broad range of trading preferences and requirements.

Industry Trends and Statistics

Recent data indicates a growing trend towards the use of trade copiers among both retail and institutional traders. A significant 30% increase in adoption over the past year highlights the expanding reliance on these tools for enhanced trading outcomes.

User Feedback and Case Studies

Case Study 1: A beginner trader used ZuluTrade to replicate strategies from top-performing traders, resulting in a 40% ROI within six months.

Case Study 2: An experienced trader utilized the Local Trade Copier to manage multiple accounts, which streamlined his operations and improved his risk management, boosting his overall efficiency by 25%.

Best Practices in Utilizing Forex Trade Copiers

Thoroughly Research Providers: Look for reviews and testimonials to gauge reliability and performance.

Start with a Demo Account: Test the copier with virtual funds to understand its functionality without financial risk.

Regular Monitoring: Continuously monitor the performance of the copier to make necessary adjustments.

Conclusion

Forex trade copiers offer significant advantages by replicating successful trading strategies, thus democratizing access to profitable trading opportunities for a diverse range of traders. By choosing the right trade copier, traders can enhance their trading activities, manage risks more effectively, and achieve greater financial outcomes. The detailed evaluation and insights provided should guide both new and experienced traders in making informed decisions about utilizing trade copiers to their fullest potential.