Introduction

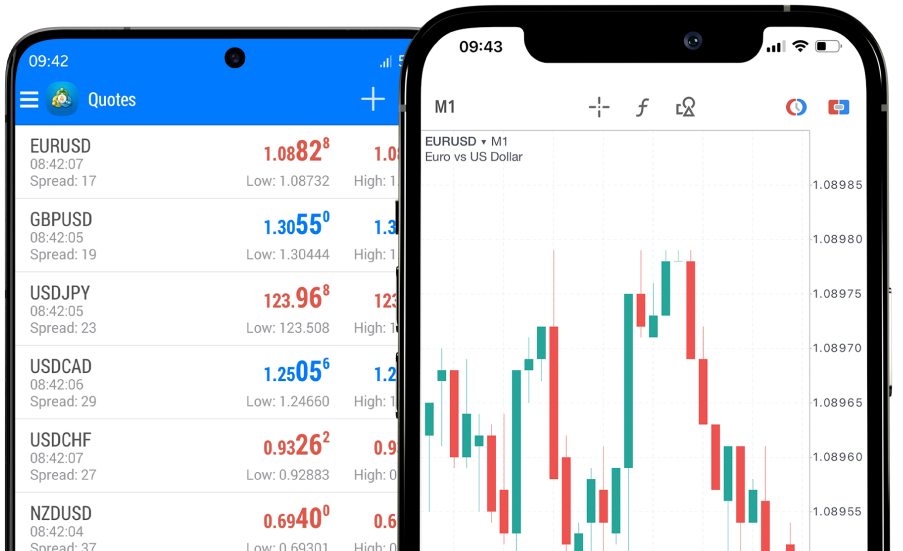

Forex hedging is an essential technique used by traders to mitigate risks associated with currency price fluctuations. By strategically using hedging, traders can protect their investments and potentially enhance profits. This comprehensive guide aims to provide both novice and experienced traders with in-depth insights into mastering forex hedging strategies, supported by reliable data and case studies. It will also explore industry trends, statistical analyses, and user feedback to underscore the effectiveness of these strategies.

Understanding Forex Hedging

What is Forex Hedging?

Forex hedging involves opening multiple positions to offset potential losses in one position by gains in another. This approach helps in managing the risk and volatility inherent in the forex market.

Types of Forex Hedging

Direct Hedging: This involves opening a position opposite to an existing trade on the same currency pair. For instance, if a trader has a long position on EUR/USD, they may open a short position on the same pair to hedge against adverse price movements.

Cross Hedging: Involves hedging one currency pair with another pair that has a high correlation. For example, a trader might hedge a position in GBP/USD with a position in EUR/USD.

Natural Hedging: This involves using business operations to offset currency risk, such as an international company earning revenue in different currencies.

Effective Hedging Strategies

Strategy 1: Using Forex Options

Forex options give traders the right, but not the obligation, to buy or sell a currency at a specified price before a certain date. This strategy allows traders to limit potential losses while maintaining the opportunity for profit.

Case Study: Utilizing Options for EUR/USD Hedging

In 2021, a European company hedged its EUR/USD exposure using options. By purchasing a put option on EUR/USD, the company protected itself against the risk of the Euro depreciating against the US Dollar, securing its revenue margins despite market volatility.

Strategy 2: Hedging with Futures Contracts

Futures contracts are agreements to buy or sell a currency at a predetermined price at a future date. They provide a straightforward way to hedge against currency risk.

Example: Hedging AUD/USD with Futures

An Australian exporter used AUD/USD futures to hedge against currency risk. By locking in an exchange rate through futures contracts, the exporter ensured predictable cash flows, regardless of fluctuations in the spot market.

Strategy 3: Utilizing Correlated Pairs

Trading correlated pairs involves opening positions in currency pairs that tend to move in tandem. This strategy can effectively balance risk.

Data Analysis: Correlation Between EUR/USD and GBP/USD

Historical data shows a strong positive correlation between EUR/USD and GBP/USD. During periods of USD strength, both pairs tend to move similarly. Traders have leveraged this correlation to hedge positions, reducing exposure to unexpected market moves.

Trends and Feedback from the Industry

Trends in Forex Hedging

Increased Use of Algorithmic Trading: Algorithmic trading systems are becoming more popular for executing hedging strategies. These systems can analyze market conditions and execute trades faster than human traders, providing more efficient hedging solutions.

Integration of Artificial Intelligence: AI and machine learning are increasingly being used to develop sophisticated hedging models. These technologies help in predicting market movements with greater accuracy, enhancing hedging effectiveness.

User Feedback

Feedback from traders using Axiory's platform indicates a high satisfaction level with the hedging tools available. Many traders appreciate the detailed analytics and user-friendly interface, which make executing complex hedging strategies more straightforward.

Conclusion

Mastering forex hedging strategies is crucial for managing risk and securing profits in the volatile forex market. By understanding and implementing techniques such as forex options, futures contracts, and trading correlated pairs, traders can protect their investments effectively. Axiory offers a robust platform with the necessary tools and resources to support traders in executing these strategies.