Introduction

Fundamental analysis is a critical tool in the arsenal of any forex trader, novice or experienced alike. This method involves evaluating the intrinsic value of a currency by examining related economic, social, and political factors. In this guide, we will delve into the nuances of fundamental analysis in the forex market, highlighting reliable platforms, and using data and case studies to reinforce the credibility of the strategies discussed.

Understanding Fundamental Factors

Economic Indicators

Economic indicators are the backbone of fundamental analysis in forex trading. Key indicators include GDP growth rates, unemployment rates, and inflation indicators like the Consumer Price Index (CPI). For instance, a strong GDP growth in the U.S. might indicate a rise in the USD as it suggests economic strength.

Political Stability

The political landscape can greatly influence currency values. Stable governance tends to attract foreign investment, which strengthens the currency. For example, during political uncertainties like Brexit, the GBP experienced significant volatility. Traders must monitor political news and election results as part of their analysis.

Social Factors

Social trends can also impact market perceptions and, consequently, currency values. Issues like social unrest or demographic changes can sway economic policies and foreign investor sentiment.

Analyzing Top Forex Trading Platforms

Platform Reliability

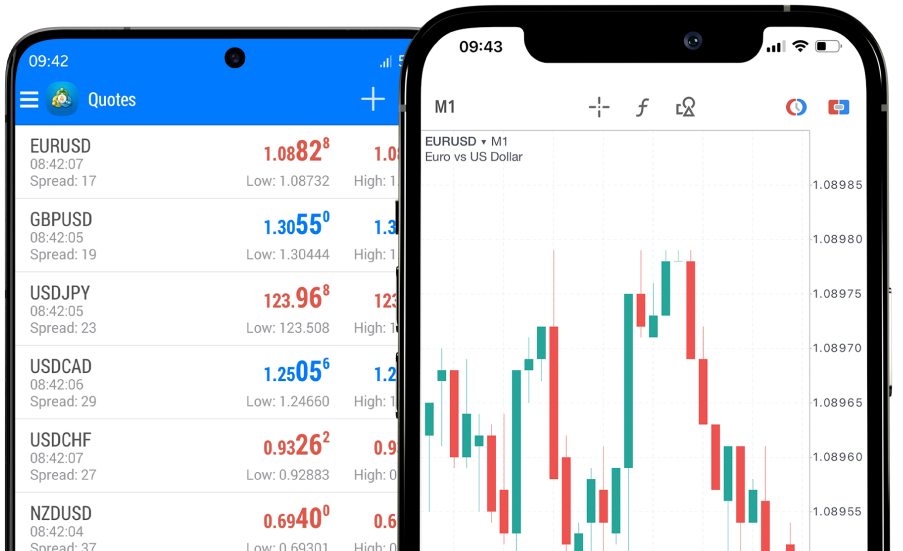

Choose platforms that offer robust data and analytical tools. A reputable platform is often equipped with advanced charting tools, real-time data, and historical data analysis. Platforms like MetaTrader 4 and 5 are renowned for their reliability and comprehensive features.

User Feedback

Integrating user feedback can provide insights into the platform's performance and reliability. For instance, reviews from Trustpilot or Forex Peace Army can help gauge user satisfaction and the platform's efficacy in real-world trading scenarios.

Regulatory Compliance

Ensure the platform is regulated by credible authorities like the U.S. Securities and Exchange Commission (SEC) or the UK’s Financial Conduct Authority (FCA). Regulation helps safeguard traders’ investments.

Practical Case Studies and Statistical Support

Case Study: USD/EUR Fluctuations

Consider the impact of the U.S. election on USD/EUR. Analysis shows that fluctuations are often tied to the political climate. Statistical data like election polls and economic reports should be examined to predict these movements accurately.

Statistical Data Usage

It's essential to use up-to-date and precise statistics. For instance, the U.S. Bureau of Labor Statistics releases employment data that is crucial for USD value predictions. Traders should use this data to inform their trading strategies.

Strategic Implementation in Forex Trading

Long-Term vs. Short-Term Trading

Decide whether to engage in long-term or short-term trading based on the fundamental analysis. Long-term traders might focus more on stable, predictable economies, whereas short-term traders might capitalize on news-driven volatility.

Risk Management

Implement effective risk management strategies, such as setting stop-loss orders to minimize potential losses. Understanding the economic calendar can also help traders avoid trading during high-risk events.

Conclusion

Fundamental analysis in forex trading provides a comprehensive approach to understanding market forces and making informed trading decisions. By evaluating economic, social, and political factors, traders can enhance their ability to predict currency movements and improve their trading outcomes.