In the ever-evolving world of forex and cryptocurrency trading, trading bots have become increasingly popular. These automated systems allow traders to execute trades based on pre-programmed algorithms, making it easier to trade 24/7 without human intervention. However, one question frequently asked by both new and experienced traders is: Are trading bots legal? This article will explore the legality of trading bots, providing insights into the regulations governing them, industry trends, and user feedback.

Introduction to Trading Bots

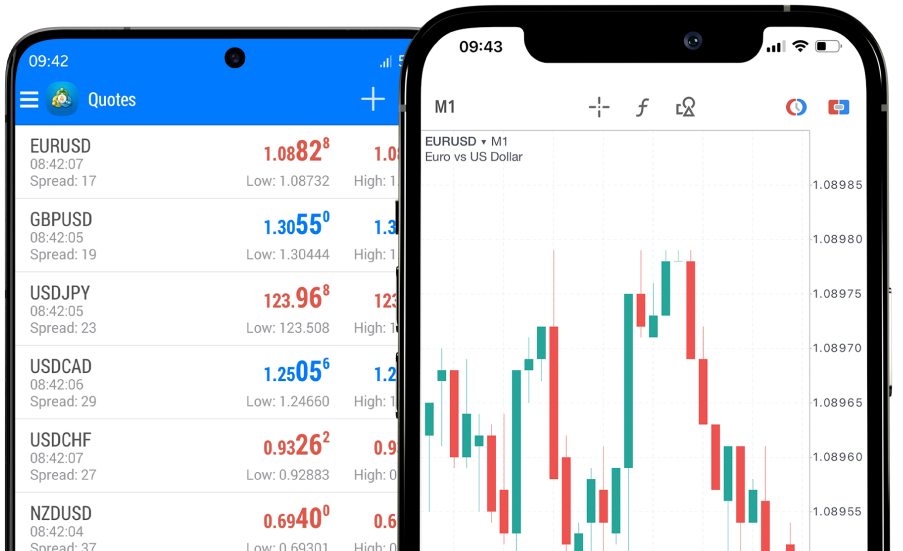

Trading bots are software programs that automate the buying and selling of financial assets, such as currencies or cryptocurrencies. They are typically designed to analyze market data, identify opportunities based on technical indicators, and execute trades automatically. These bots operate on platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cryptocurrency exchanges like Binance and Coinbase.

For many traders, bots offer a hands-off approach to trading, eliminating emotional decisions and potentially increasing profitability through consistent execution. However, the legality of trading bots varies by jurisdiction and platform, making it important to understand the regulations that apply.

Are Trading Bots Legal?

In most cases, trading bots are legal. However, the legality depends on how they are used and where they are deployed. Below are some factors that traders need to consider when determining whether using a trading bot is legal.

1. Regulation by Jurisdiction

Most countries that regulate forex and cryptocurrency trading allow the use of trading bots as long as they adhere to local laws. For example:

In the United States, trading bots used in regulated markets must comply with guidelines set by the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). These bodies ensure that bots do not manipulate markets or engage in illegal activities like spoofing or wash trading.

In the European Union, automated trading is legal, but bots must operate within the guidelines set by the European Securities and Markets Authority (ESMA). This includes adhering to risk management protocols and ensuring transparency in trade execution.

2. Broker and Platform Policies

While trading bots may be legal in a given country, their use depends on the policies of the broker or exchange where they are deployed. Some brokers and exchanges explicitly allow the use of trading bots, while others may restrict or ban certain strategies like high-frequency trading (HFT) or scalping. For example, many forex brokers support the use of Expert Advisors (EAs) on MT4 and MT5, but some may impose limits on the types of strategies a bot can execute.

3. Ethical and Legal Considerations

Even if bots are legal, they must comply with ethical trading practices. Bots designed to manipulate market prices, delay trade execution, or create artificial market activity could be considered illegal. Traders using these bots could face penalties, including account suspension or legal action from regulatory authorities. Ensuring that your trading bot operates within fair trading practices is essential to avoid legal issues.

Case Studies: Legal Use of Trading Bots

Case Study 1: A Forex Trader in the United Kingdom

A forex trader in the United Kingdom used a trading bot on a broker platform regulated by the Financial Conduct Authority (FCA). The bot executed trades based on technical analysis indicators like Moving Averages (MA) and Relative Strength Index (RSI). The trader was able to generate consistent monthly returns of 5% while adhering to FCA guidelines, which required transparent trade reporting and proper risk management.

Case Study 2: A Cryptocurrency Trader in the U.S.

A cryptocurrency trader in the U.S. used a trading bot to execute trades on Binance, focusing on high-frequency trading (HFT) strategies. While Binance allowed the use of bots, the trader needed to ensure the bot adhered to anti-market manipulation rules set by the CFTC. After ensuring the bot followed the platform’s policies, the trader saw a 15% increase in profit over six months.

Industry Trends: The Rise of Trading Bots

The use of trading bots has increased significantly in recent years. According to a report by Business Research Insights, the algorithmic trading market is expected to grow at a 12% compound annual growth rate (CAGR) between 2021 and 2026. This growth is largely driven by the increasing adoption of trading bots across forex, cryptocurrency, and stock markets. Traders are seeking automation to reduce human error and improve efficiency, especially as markets become more complex and globalized.

A survey conducted by CoinTelegraph found that 40% of cryptocurrency traders use trading bots to automate their strategies, particularly for high-frequency trading and market-making strategies. Forex traders, on the other hand, are increasingly using Expert Advisors (EAs) on platforms like MT4 and MT5 to execute strategies based on technical indicators.

User Feedback: Pros and Cons of Trading Bots

Pros:

Efficiency: Trading bots can execute trades faster than humans, especially in fast-moving markets like cryptocurrencies. This speed can be critical for strategies like high-frequency trading.

Emotion-Free Trading: Bots follow predefined rules and strategies, eliminating emotional biases such as fear or greed that often lead to poor trading decisions.

24/7 Market Monitoring: Bots can monitor and trade the market around the clock, making them especially useful for global markets like forex and crypto, which operate 24/7.

Cons:

Over-Optimization: Some bots are over-optimized for historical data, leading to underperformance in live markets. Traders need to be cautious when backtesting bots to ensure they will work in real-time conditions.

Regulatory Risks: Bots must comply with local regulations, and traders must ensure that their bots do not engage in unethical practices like market manipulation.

Market Conditions: Bots perform best in trending or predictable markets. In highly volatile or unpredictable markets, bots can underperform or generate losses if not carefully managed.

Conclusion

In most jurisdictions, trading bots are legal, but traders must ensure that the bots they use comply with both local regulations and the specific policies of the platforms they trade on. By following ethical guidelines and using bots within legal boundaries, traders can significantly enhance their trading efficiency, reduce emotional decision-making, and increase their profit potential.

Whether you are a novice trader exploring automated systems or an experienced trader looking to scale your operations, trading bots offer a valuable solution in today’s fast-paced markets. However, understanding the legal implications and ensuring compliance with regulations is critical to success.