Introduction

In 2024, the world of forex trading continues to grow and evolve, attracting both novice and experienced traders alike. Choosing the best online brokerage for forex trading is crucial to success in this fast-paced market. This article will explore the top online forex brokers for 2024, focusing on their features, advantages, and potential drawbacks. Our goal is to provide a comprehensive guide that helps traders make informed decisions. We will analyze brokers based on factors such as trading platforms, fees, customer service, regulation, and more.

1. Key Criteria for Choosing a Forex Brokerage

When selecting an online brokerage for forex trading, several key criteria should be considered:

Regulation and Security: A reliable broker should be regulated by reputable financial authorities, such as the FCA (UK), ASIC (Australia), or CFTC (US). This ensures the safety of funds and fair trading practices.

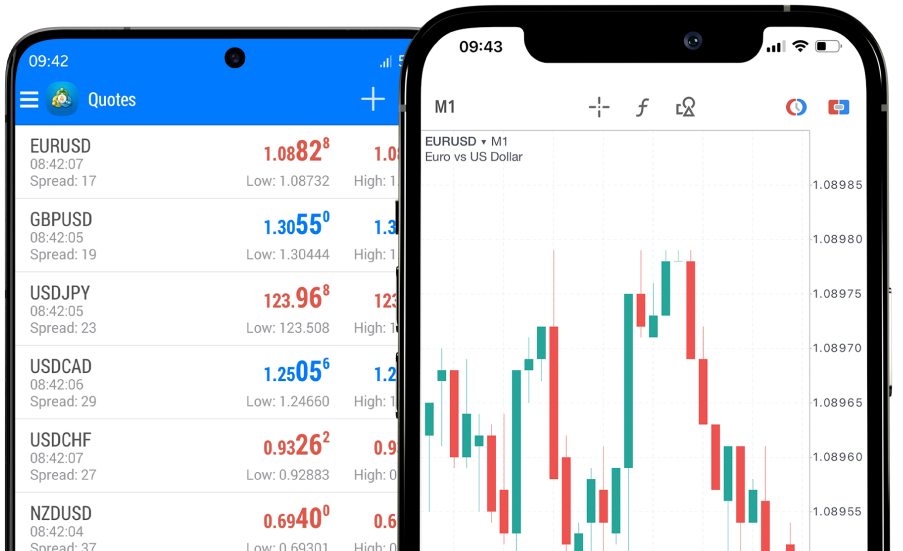

Trading Platform: The trading platform should be user-friendly, offer advanced charting tools, and support various trading strategies. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

Fees and Spreads: Lower fees and tighter spreads can significantly affect a trader’s profitability. Some brokers offer commission-free trading with slightly wider spreads, while others charge commissions but offer tighter spreads.

Customer Support: Efficient and responsive customer support is essential, especially for new traders. Look for brokers that offer 24/7 support via multiple channels such as live chat, email, and phone.

Educational Resources: A good broker should provide educational resources, including webinars, tutorials, and market analysis to help traders improve their skills and stay updated with market trends.

2. Top Online Forex Brokers for 2024

Based on the criteria mentioned above, we have identified some of the best online forex brokers for 2024:

a) IG Group

Overview: IG Group is a well-established broker regulated by top-tier authorities, including the FCA and ASIC. Known for its robust trading platform and comprehensive market access, IG offers a range of trading instruments beyond forex, including CFDs, stocks, and commodities.

Pros:

Wide range of trading instruments.

Competitive spreads and fees.

Excellent educational resources and market analysis tools.

Strong regulatory oversight.

Cons:

Higher minimum deposit compared to other brokers.

Limited leverage options for retail clients.

Case Study: A professional trader who transitioned to IG Group reported a 30% increase in trading efficiency due to the platform’s advanced charting tools and reliable execution speeds.

b) Saxo Bank

Overview: Saxo Bank is a high-quality broker that offers a comprehensive suite of trading products. It is particularly known for its sophisticated trading platforms and extensive range of research and analysis tools.

Pros:

Extensive range of forex pairs and CFDs.

Professional-grade trading platforms (SaxoTraderGO and SaxoTraderPRO).

In-depth market research and analysis.

Cons:

Higher trading costs, especially for smaller accounts.

Minimum deposit requirements may be prohibitive for beginners.

Case Study: An institutional investor praised Saxo Bank for its robust risk management tools and detailed market insights, which enhanced their portfolio management strategy.

c) Plus500

Overview: Plus500 is a user-friendly broker, ideal for beginners. It is regulated by several top financial authorities and offers commission-free trading on most products, including forex, stocks, and commodities.

Pros:

User-friendly trading platform.

Commission-free trading with tight spreads.

Good customer support.

Cons:

Limited advanced trading features.

Restricted access to some financial instruments.

Case Study: A new trader found Plus500’s platform easy to navigate and appreciated the absence of hidden fees, which helped them manage their trading budget more effectively.

d) Interactive Brokers

Overview: Interactive Brokers is renowned for its wide range of trading instruments and low trading costs. It caters to both retail and institutional traders and offers a highly customizable trading platform.

Pros:

Wide range of instruments and markets.

Low trading costs and competitive fees.

Advanced trading tools and algorithms.

Cons:

Complex platform may be overwhelming for beginners.

Limited customer support outside of business hours.

Case Study: An experienced trader highlighted Interactive Brokers’ competitive pricing model, which allowed them to maximize their returns by minimizing transaction costs.

3. Conclusion

Choosing the right online forex broker is essential for success in the forex market. It involves considering various factors such as regulation, fees, platform features, and customer support. Based on our research, IG Group, Saxo Bank, Plus500, and Interactive Brokers are among the best choices for 2024, each catering to different types of traders. Whether you are a beginner or a seasoned trader, selecting the right broker can greatly impact your trading performance.

By carefully assessing your trading needs and comparing the features of different brokers, you can find the best online brokerage that aligns with your goals and trading style.