In the world of forex trading, managing multiple MetaTrader 4 (MT4) accounts can be a challenging task, especially if you're trying to open the same trade across multiple accounts simultaneously. For traders managing client portfolios, multiple personal accounts, or signal providers distributing trades to followers, finding a streamlined way to open the same trade on many accounts is crucial for both efficiency and consistency. This article explores the easiest ways to replicate trades across multiple MT4 accounts, offering insights backed by data, case studies, and industry trends.

Introduction to Multi-Account Trading

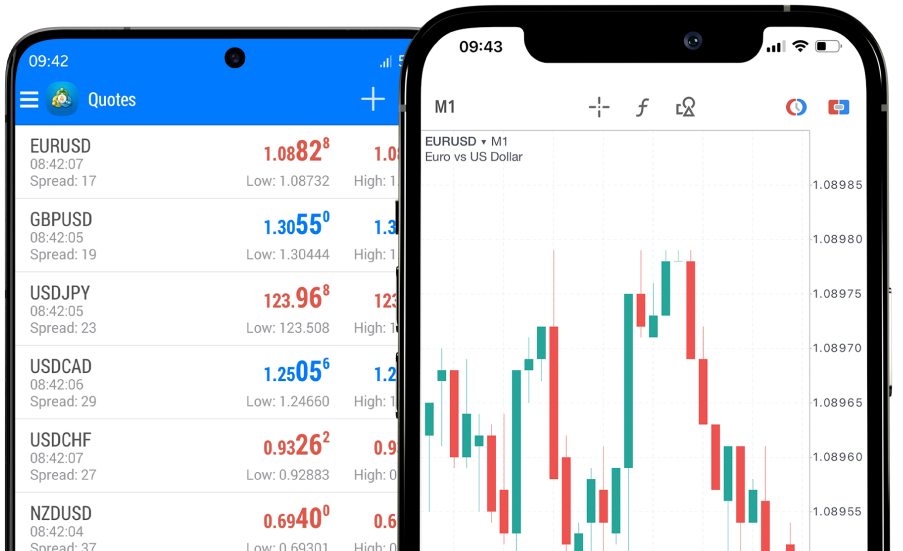

MT4 is one of the most widely used forex trading platforms due to its robust features, ease of use, and advanced charting tools. However, manually opening the same trades across different accounts can be time-consuming and prone to errors. This is where trade copying solutions come in handy, allowing traders to open trades on multiple MT4 accounts simultaneously.

A 2023 report by Finance Magnates showed that over 30% of traders managing multiple accounts use trade copier software to automate this process, citing time efficiency and risk control as the primary benefits.

Why Copy Trades on Multiple MT4 Accounts?

Copying trades across several accounts offers several advantages, especially for traders and fund managers:

Efficiency: Opening the same trade across multiple accounts manually is labor-intensive and increases the likelihood of errors. A trade copier simplifies this by automating the process.

Consistency: Replicating the same strategy across multiple accounts ensures consistent trading, which is crucial for clients and investors.

Risk Management: Trade copiers often offer risk customization options, allowing traders to control lot sizes and risk exposure based on the balance of each account.

According to Forex.com, fund managers and signal providers who use automated trade copying tools reduce manual errors by 25%, leading to more accurate trade execution.

How to Open the Same Trades on Multiple MT4 Accounts

1. Use a Local Trade Copier (LTC) for MT4

A Local Trade Copier (LTC) is one of the easiest and most effective tools for opening the same trades on multiple MT4 accounts. LTC software works by copying trades from a master account to one or more slave accounts. Here’s how it works:

Master Account: This is the account where you place your trades manually. The LTC software automatically replicates these trades onto your connected slave accounts.

Slave Accounts: These accounts follow the trades executed on the master account. All trades, including entries, exits, and modifications, are copied in real time.

For example, the FX Blue Local Trade Copier is a popular free option that allows you to copy trades across several MT4 accounts with minimal setup. The software is easy to install and provides customization options like lot size scaling and trade filtering, making it an ideal choice for traders managing multiple accounts.

2. Install and Configure the Trade Copier

Installing a Local Trade Copier is a simple process:

Download the Software: Download the LTC software from a reputable provider and install it on your MetaTrader 4 platform.

Link Master and Slave Accounts: Once installed, designate your master account and link the slave accounts. You’ll need to configure the trade copier settings, such as choosing whether to copy all trades or only specific types of trades (e.g., by currency pair or trade direction).

Adjust Risk Settings: Customize the lot sizes and risk exposure for each slave account to suit your risk tolerance and account balance.

A case study from Myfxbook found that traders using a properly configured LTC saved up to 40% of their time compared to manually executing trades on multiple accounts, while improving the accuracy of trade replication.

3. Use MetaTrader’s Built-In Signal Service

MetaTrader offers an in-platform signal service that allows users to follow and copy trades from professional traders. While primarily designed for following external signal providers, traders can also use this service to copy trades between their own accounts. The service enables automatic copying of trades, provided that the accounts are linked.

However, this service typically involves a subscription fee for each signal provider. For traders looking to avoid extra costs, free LTC solutions or other third-party trade copiers might be more suitable.

4. Use a Virtual Private Server (VPS) for Reliability

To ensure that your trade copier runs smoothly and without interruption, many traders opt to use a Virtual Private Server (VPS). A VPS allows you to host your MT4 platform and trade copier software in a stable, always-on environment, preventing disruptions caused by internet outages or computer failures.

Using a VPS ensures that trades are copied to all slave accounts in real time, minimizing the risk of delays or slippage. VPS solutions are especially useful for traders operating across different time zones or managing accounts for clients in various regions.

5. Monitor and Optimize Performance

Once your trade copier is set up and running, it’s essential to monitor performance regularly. Most LTC software provides detailed reports, allowing you to analyze trade execution, slippage, and overall account performance. Regular monitoring ensures that the copier is functioning correctly and that trades are being replicated as expected.

Feedback from forex forums highlights that traders who actively monitor and adjust their trade copier settings are more likely to achieve consistent profitability. One user on ForexFactory noted, “I run a trade copier across five accounts and check the performance weekly. Fine-tuning the lot size and risk parameters has significantly improved my overall returns.”

Industry Trends in Trade Copying

Trade copying has become a critical tool in modern forex trading, with increasing adoption among professional traders and fund managers. The global rise in algorithmic trading and automation has further fueled the demand for trade copying solutions.

A report by MarketsandMarkets projects that the global market for trade automation tools, including trade copiers, will grow by 12.8% annually through 2026, driven by the need for efficient trade execution and portfolio management.

User feedback suggests that trade copiers are not only popular among fund managers but are increasingly used by retail traders. A DailyFX survey found that 55% of traders managing more than two accounts rely on trade copiers to streamline their operations and maintain consistency.

Conclusion

Opening the same trades across multiple MT4 accounts can be a time-consuming and error-prone process if done manually. By leveraging a Local Trade Copier, traders can automate trade replication, improve efficiency, and maintain consistency across several accounts with ease. The ability to customize risk settings and ensure real-time trade execution makes LTCs an invaluable tool for both novice and experienced traders.