Introduction

Investing with options offers traders a flexible and strategic approach to navigating the financial markets. Gold, often viewed as a safe-haven asset, presents unique opportunities for those utilizing options to manage risk and enhance returns. This article delves into the concept of gold optionality, examining its significance, strategies for investing, and the tools provided by Saxo Bank to facilitate these investments. Supported by accurate data and case studies, this guide aims to provide both novice and experienced traders with a comprehensive understanding of investing with options in the context of gold.

Understanding Gold Optionality

What is Gold Optionality?

Gold optionality refers to the use of options contracts to speculate on or hedge against movements in the price of gold. An option gives the holder the right, but not the obligation, to buy or sell gold at a predetermined price before a specified expiration date. This financial instrument offers traders the ability to profit from gold price movements while limiting downside risk.

Types of Options

Call Options: A call option gives the holder the right to buy gold at a specified price. Traders purchase call options when they anticipate a rise in gold prices.

Put Options: A put option gives the holder the right to sell gold at a specified price. Traders buy put options when they expect a decline in gold prices.

Strategies for Investing in Gold Options

Strategy 1: Protective Put

A protective put strategy involves holding a long position in gold and purchasing a put option to protect against potential losses. This strategy is akin to an insurance policy, limiting downside risk while maintaining the potential for gains.

Case Study: Protective Puts During Market Volatility

In 2020, during the COVID-19 pandemic, investors used protective puts to safeguard their gold investments. As gold prices fluctuated, those with put options were able to limit their losses during downturns while benefiting from the subsequent recovery in prices.

Strategy 2: Covered Call

A covered call strategy involves holding a long position in gold and selling call options. This strategy generates income through premiums received from selling the call options, which can offset potential declines in the value of the underlying gold.

Example: Generating Income with Covered Calls

Investors holding physical gold or gold ETFs in 2021 used covered call strategies to generate additional income. By selling call options at strike prices above the current market price, they earned premiums while still benefiting from potential price increases up to the strike price.

Strategy 3: Straddle

A straddle strategy involves buying both a call option and a put option at the same strike price and expiration date. This strategy profits from significant price movements in either direction, making it ideal during periods of high volatility.

Data Analysis: Straddle Performance in Volatile Markets

Historical data indicates that straddle strategies can be highly profitable during periods of increased market volatility. For instance, during the financial turmoil of 2008, straddle strategies on gold options provided substantial returns as gold prices experienced large swings.

Tools and Resources Provided by Saxo Bank

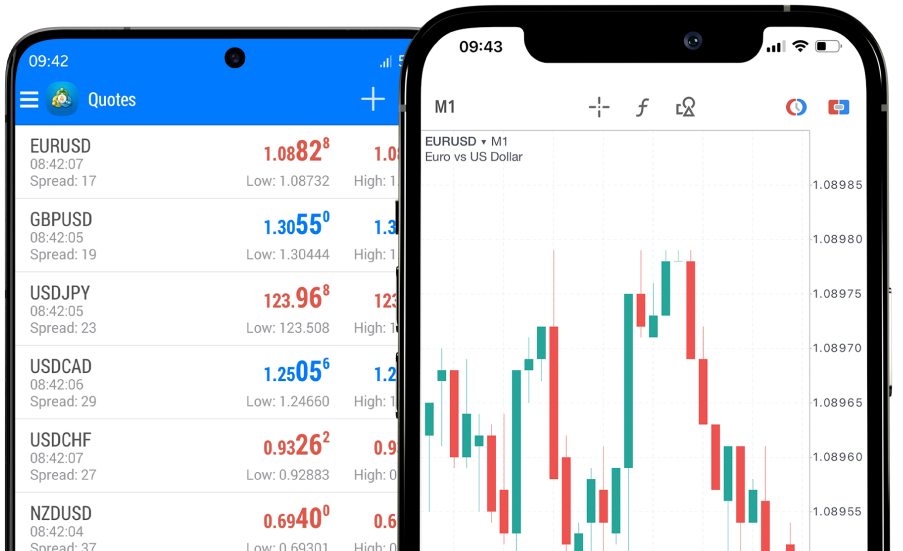

Saxo Bank's Trading Platform

Saxo Bank offers a sophisticated trading platform equipped with advanced tools for options trading. The platform provides real-time market data, comprehensive charting tools, and a wide range of options contracts to cater to various trading strategies.

Educational Resources

Saxo Bank provides extensive educational resources, including webinars, tutorials, and articles, to help traders understand and effectively implement options strategies. These resources are invaluable for both beginners and experienced traders looking to enhance their knowledge and skills.

User Feedback

Feedback from Saxo Bank users highlights the platform's reliability and the wealth of resources available. Traders appreciate the intuitive interface, robust analytical tools, and the support provided for executing complex options strategies.

Trends in Gold Optionality

Increased Interest in ESG Investments

Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions. Gold sourced through ethical and sustainable practices is becoming more attractive to investors. This trend is reflected in the growing demand for ESG-compliant gold options.

Integration of AI and Machine Learning

Artificial intelligence and machine learning are transforming options trading by providing sophisticated tools for predicting market movements and optimizing trading strategies. Saxo Bank's platform incorporates these advanced technologies to enhance trading efficiency and accuracy.

Conclusion

Investing with options, particularly in gold, offers traders a versatile and effective means of managing risk and enhancing returns. Strategies such as protective puts, covered calls, and straddles provide various avenues for profiting from gold price movements while controlling downside risk. Saxo Bank's comprehensive platform and educational resources equip traders with the necessary tools to successfully implement these strategies.