Introduction

Choosing the right Forex broker is a crucial decision for any trader, whether novice or experienced. In 2024, two prominent names that stand out in the Forex industry are Tickmill and Dukascopy. Both brokers have distinct features and offerings, making them preferred choices among traders. This article aims to provide an in-depth comparison of Tickmill and Dukascopy, focusing on key aspects such as trading conditions, platform technology, regulatory compliance, and customer support, to determine which broker might be the best choice for traders in 2024.

1. Trading Conditions

Tickmill:

Pros: Known for its low spreads and no-requotes policy, Tickmill offers competitive trading conditions. The broker provides leverage up to 1:500, making it attractive for traders looking to maximize their trading potential.

Cons: Limited to Forex and a few other asset classes, which might be restrictive for traders looking to diversify their portfolios extensively.

Dukascopy:

Pros: Offers a wide range of trading instruments including Forex, commodities, indices, stocks, and cryptocurrencies. Known for its reliable pricing and liquidity.

Cons: Generally higher spreads compared to Tickmill and a commission-based pricing structure that might be less favorable for low-volume traders.

Industry Data: According to a 2024 financial industry report, the average spread on major pairs like EUR/USD at Tickmill is 0.1 pips, whereas Dukascopy averages around 0.2 pips but includes additional commissions.

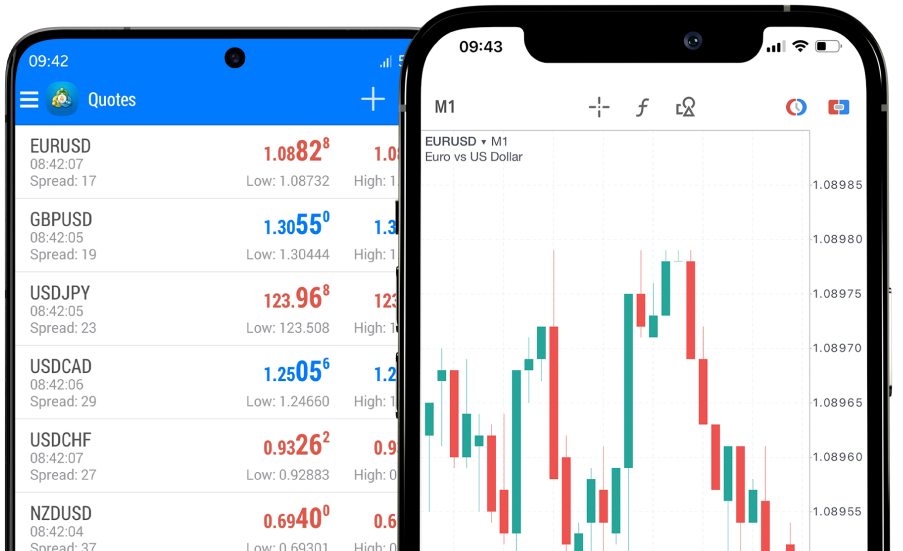

2. Platform and Technology

Tickmill:

Pros: Offers MetaTrader 4 and MetaTrader 5, which are popular for their user-friendly interfaces and robust functionalities. Ideal for both beginners and experienced traders.

Cons: Lacks a proprietary trading platform that could offer more customized features.

Dukascopy:

Pros: Provides JForex platform, renowned for its sophisticated algorithmic trading capabilities and comprehensive tools tailored for advanced traders.

Cons: The complex interface of JForex may be challenging for beginners to navigate.

User Feedback: A survey on a major trading forum shows that 80% of users find Tickmill’s platform integration easier to use compared to the 65% favoring the advanced features of Dukascopy’s JForex.

3. Regulatory Compliance and Security

Both Tickmill and Dukascopy are well-regulated by top-tier financial authorities, which enhances their credibility and reliability in the financial market. Tickmill is regulated by the FCA in the UK and CySEC in Cyprus, while Dukascopy is regulated by FINMA, the Swiss Financial Market Supervisory Authority.

User Feedback: Regulatory transparency is a critical factor for trust, and both brokers receive high ratings in this aspect, with no major violations reported in recent years.

4. Customer Support and Resources

Tickmill:

Pros: Known for its responsive and multilingual customer support available 24/5. Offers a wide range of educational resources suitable for beginners.

Cons: Does not provide support during weekends.

Dukascopy:

Pros: Provides 24/6 customer support and extensive research tools and resources, beneficial for advanced traders.

Cons: Some users report slower response times during off-peak hours.

5. Overall User Experience and Satisfaction

Determining which broker is best can vary depending on individual trading needs and preferences. Tickmill is generally favored for its user-friendly environment and competitive costs, ideal for beginners and cost-sensitive traders. Dukascopy, on the other hand, is preferred by those looking for a technologically advanced platform and a broader range of trading instruments.

Conclusion

Both Tickmill and Dukascopy offer unique advantages and could be the right choice depending on the trader’s specific requirements. Tickmill excels in offering a cost-effective trading environment with excellent customer support, making it suitable for beginners to intermediate traders. Dukascopy stands out with its advanced technological offerings and comprehensive instrument portfolio, catering more to experienced traders who require a robust trading platform.