Introduction

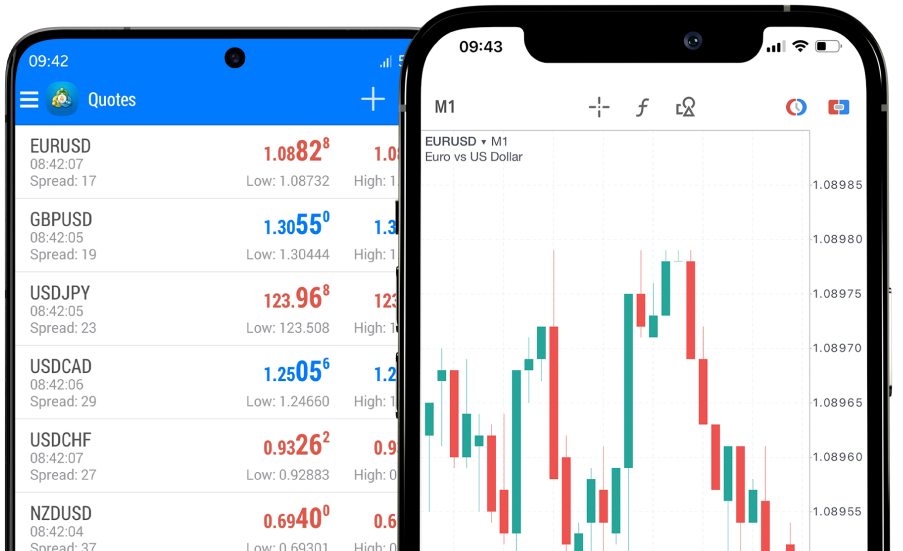

Gold has always been a critical commodity in financial markets, often considered a safe-haven asset in times of economic uncertainty. For forex traders, understanding the indicators of gold can provide valuable insights into market movements and trading opportunities. This article aims to provide both novice and experienced forex traders with an in-depth analysis of the key indicators that influence gold prices. We will explore various aspects such as market trends, statistical data, and user feedback, emphasizing the professional, objective, and neutral presentation of the information.

Fundamental Indicators

Economic Data Releases

Economic data releases, such as GDP growth rates, employment reports, and inflation figures, significantly impact gold prices. For instance, higher inflation often leads to higher gold prices as investors seek to hedge against currency devaluation. Conversely, strong economic growth and employment figures can lead to lower gold prices as risk appetite increases.

Central Bank Policies

Central bank policies, particularly those of the Federal Reserve, European Central Bank, and Bank of Japan, play a crucial role in determining gold prices. Interest rate decisions and monetary policy statements can affect gold's attractiveness as an investment. For example, lower interest rates generally lead to higher gold prices as the opportunity cost of holding non-yielding assets like gold decreases.

Geopolitical Events

Geopolitical events, such as wars, political instability, and trade disputes, can lead to increased demand for gold as a safe-haven asset. Historical data shows that during periods of heightened geopolitical tension, gold prices tend to rise. This is evident in events like the US-China trade war and the Russia-Ukraine conflict.

Technical Indicators

Moving Averages

Moving averages (MAs) are widely used by traders to identify trends and potential entry and exit points. The 50-day and 200-day moving averages are particularly significant. A common strategy is the "golden cross," where the 50-day MA crosses above the 200-day MA, indicating a potential bullish trend. Conversely, the "death cross," where the 50-day MA crosses below the 200-day MA, signals a bearish trend.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. An RSI above 70 indicates that gold is overbought, suggesting a potential price correction. An RSI below 30 indicates that gold is oversold, suggesting a potential price rebound. Traders often use the RSI to identify potential reversal points.

Fibonacci Retracement

Fibonacci retracement levels are used to identify potential support and resistance levels. By plotting key levels, traders can anticipate areas where gold prices might reverse. The most common retracement levels are 38.2%, 50%, and 61.8%. These levels help traders determine entry and exit points based on historical price movements.

Sentiment Indicators

Commitments of Traders (COT) Report

The Commitments of Traders (COT) report, released weekly by the Commodity Futures Trading Commission (CFTC), provides valuable insights into the positioning of various market participants. By analyzing the net long or short positions of commercial and non-commercial traders, traders can gauge market sentiment and potential future price movements.

Gold Exchange-Traded Funds (ETFs)

The inflows and outflows of gold ETFs, such as the SPDR Gold Trust, provide an indication of investor sentiment. Significant inflows suggest increased demand for gold, while outflows indicate decreased demand. Tracking ETF holdings can help traders understand broader market sentiment and potential price trends.

Market Surveys and Reports

Market surveys and reports from reputable sources like the World Gold Council and Bloomberg can provide valuable insights into market sentiment. These reports often include forecasts, analyst opinions, and data on gold demand and supply, helping traders make informed decisions.

Statistical Data and Trends

Historical Price Trends

Analyzing historical price trends of gold can provide insights into potential future movements. By examining past performance during similar economic and geopolitical conditions, traders can identify patterns and make informed predictions. For instance, gold prices tend to rise during economic recessions and fall during periods of robust economic growth.

Seasonal Trends

Gold prices often exhibit seasonal trends. For example, prices tend to rise in January and September due to increased demand during the Chinese New Year and the Indian wedding season. Understanding these seasonal trends can help traders anticipate price movements and adjust their strategies accordingly.

User Feedback and Case Studies

Retail Trader Sentiment

User feedback from retail traders can provide valuable insights into market sentiment. Platforms like TradingView and Forex Factory often feature sentiment indicators and discussions that reflect the collective outlook of retail traders. Analyzing this sentiment can help traders understand the prevailing market mood and potential price directions.

Case Study: The Impact of COVID-19

The COVID-19 pandemic provides a recent case study of how various indicators influence gold prices. During the initial outbreak in early 2020, gold prices surged as investors sought safe-haven assets amidst global uncertainty. Central banks implemented unprecedented monetary easing, leading to lower interest rates and further boosting gold prices. This case study highlights the interplay of economic data, central bank policies, and geopolitical events in driving gold prices.

Conclusion

Understanding the indicators of gold is crucial for forex traders seeking to navigate the complexities of the market. By analyzing economic data, central bank policies, geopolitical events, technical indicators, sentiment indicators, and historical trends, traders can make informed decisions and capitalize on trading opportunities. Maintaining a professional, objective, and neutral approach to analyzing these indicators is essential for success in the forex market.